Paying to Pay (Part 1 of 2)

How to save money sending money to your collaborator in another country.

Almost no one in Canada uses cash on a regular basis anymore. Interac, the Canadian bank card equivalent to Venmo and Zelle, makes paying with a tap or e-mail simple and inexpensive—as long as the recipient is in Canada. However, as soon as money needs to cross a border, things get exponentially more complicated and expensive.

Cross-border payments have to rank as one of my least favourite modern-day nuisances.

On one level, I am amazed by how far we’ve come. I am old enough to remember when sending money to someone outside of Canada involved putting an international money order in a stamped envelope, hoping the postal service wouldn’t lose it, and waiting to hear if the bank on the other end would actually cash it. Does anyone else remember being thankful for Traveller’s cheques? Modern financial services providers like Western Union and PayPal have made things possible that were not even conceivable only three decades ago. Now, paying comic book collaborators on the other side of the world happens every day.

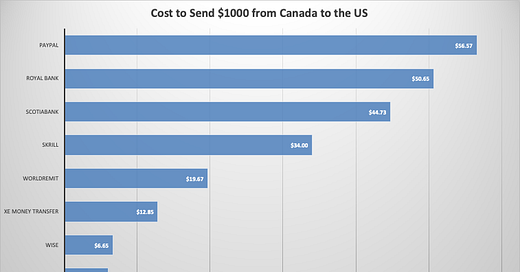

Modern fintech has made paying your collaborator in another country doable but has added a baffling amount of complexity and, in many cases, significant cost. Have a look at the attached spreadsheet for one comparison of options. In one scenario, the added cost to send $1000 to the US from Canada varied from a low of $1.06 to a high of $56.57 US! Sadly, this expense is not hypothetical. For one recent project, I ended up paying at least $350 US just for the ability to pay my collaborators. Paying that much just for the privilege of spending my money sent me down the rabbit hole, looking for ways to reduce this expense in future projects. In the process, I’ve found some useful tips, an app that will help you navigate the options, and a renewed conviction that we should all be using a better way.

The key to spending less money on cross-border payments is understanding how fintech firms make money.

Service Fees

Service fees are the most transparent of the costs associated with sending money abroad. It makes sense: You are buying a service, and the service provider is charging for it. But even in this category, there are a plethora of variables. For example, in the scenario where a Canadian is sending $1000 to a US collaborator if you use Wise, the fees will range from 9.45 CAD to 46.57 CAD. In the same scenario, XE Money Transfer has no service fee at all.

Fees tend to vary based on how you fund the transfer (with a credit card usually, although not always, being the most expensive), the time it takes to deliver the money, and whether or not the fee is a flat fee or is based on a percentage of the transaction.

Tips

Test the route. Transfer a small amount of money to start, but once the payment route is established, consider sending fewer but larger sums, especially if you are using a provider with fixed-rate fees.

Know the least expensive way to pay your money to your provider. In the Wise example, you get the lowest fee if you pay by bank transfer (Warning: Your bank may charge a fee for this), and the most expensive method is by credit card.

Buyer beware. If there are no service fees, know that the provider is making money off of you another way.

Exchange Rate Premiums

As strange as it may feel, currency is bought and sold, just like steel or wheat. How this works1 is complex but vastly oversimplifying it largely comes down to supply and demand. If more people need and value US currency than Mexican pesos, the value of a single US dollar will be worth more. When two holders exchange money, the exchange rate is the ratio of the “price” of one country's currency relative to another. As the US dollar serves as the default reserve currency in much of the world, most exchange rates involve US dollars as one-half of the pairing.

The exchange rate for a currency changes minute by minute as it is traded on exchanges. Again, trading may feel strange, but it makes sense. As a naive teenager, I once pulled out a Canadian $10 bill to pay for my meal at a truck stop cafe in Georgia, and the waitress looked at me like I had handed her Monopoly money. Foreign exchange is the mechanism that allows customers to pay with the currency preferred by vendors in the local market.

The mid-market rate - also known as the interbank rate - represents the real-time value of one currency against another and is often considered the fairest exchange rate available. Service providers make money - and I’d venture to guess most of their money - simply buying a currency at the mid-market rate and selling it to you at a rate that gives them a profit. This markup or “FX premium” can vary dramatically from provider to provider and even at a single provider based on how you pay, etc.

Have a look at the example spreadsheet, and you’ll see that the premiums range from 0.08% at Western Union to a staggering 5.43% at PayPal. If you are paying a collaborator thousands of dollars, these premiums can really add up.

Tips

Be aware of this largely hidden fee and shop for the best provider accordingly.

Do not assume that the premium today will always be the same. In rare instances, some providers may even offer an FX discount (see Wise in the CLP example). Remember, they can still make a profit if they sell you your funds for less than they bought them for.

Be especially wary of service providers offering $0 transaction fees and investigate their FX premium percentage.

Time is money

How quickly your payment gets to your collaborator can vary from same-day delivery to well over a week. Why? Some of the reasons are regulatory. Transactions take three days to “settle” - become official in an accounting sense - so with anything less than this, the provider is taking a risk that the source of the money you sent is good for the funds. This becomes more critical to them the more significant the sum you are trying to send. But this can only account for some of the variability. It turns out that delaying the delivery of your funds can also be profitable.

The longer the provider holds your money, the more opportunity it gives their traders to find a moment where a better exchange rate can be had for your funds. Effectively, it gives them time to generate an exchange rate premium, whether or not they state that formally.

The other way service providers can earn a profit by delaying your money is simply by reinvesting it, even if it is just for a day. Consider the following back-of-the-napkin calculation. In 2023, PayPal's total payment volume (TPV) reached roughly $1.53 trillion or $4.19 billion daily. If they were to hold that money and invest it in secure money market funds at a rate of 4.5% for just one day, the annual return would be $188 million dollars! Taking their time to deliver your funds can generate a lot of profit.

Tips

In general, the longer it takes to transfer the funds to your collaborator, the less you will be charged to send the money.

When you pay your collaborator can make a huge difference. Do like the fintech companies, and pay attention to trends in mid-market exchange rates for the countries involved. (For example, the potential for US tariffs on Canadian goods is putting downward pressure on the Canadian dollar. As such, it would likely be beneficial to pay my collaborators expecting US funds sooner rather than later. I am already paying 6.8% more for US talent today than I would have on May 31st, 2024, simply because of the exchange rate.)

If you live in a country with a stable currency, consider paying your collaborator in their local currency to take advantage of any downward trend in their home currency. Conversely, ask to be paid in US dollars if your country’s dollar is likely to lose value.

Repeat Business

Financial services companies know that if they can get you to use their service once, you will be more likely to use it again. As such, they frequently use “first-time customer” rates for fees and exchange rates. Use this to your advantage, and definitely, buyer beware.

Tip

Ask your collaborator on the receiving end which services they prefer to use. Then, shop among these to see if any “first-time user” promo codes are available.

Do not assume your second transaction will cost the same amount. In the USD/CLP example in the spreadsheet, the Western Union example includes a first-time user promotional exchange rate. A second transaction would potentially cost in the order of $100 more for the same $1000 transfer!

Taming the Complexity

If you’ve made it this far in this post, you should have a sense of how sending money to a collaborator in another country can be both challenging and costly. The plethora of variables to consider is exhausting.

I haven’t even mentioned how not all services work in all countries. Nigeria, for example, only got PayPal in the last few years, even though it is one of the most populous countries on the planet. Several countries, largely those under sanctions, offer no way for your collaborator to receive funds. Even how your money will be received can change the amount you need to pay for the privilege of paying. These variables change seemingly daily.

Thankfully, there’s an app for that. While writing this article, I discovered Monito. Monito.com is a comparison website for foreign exchange services and money transfers. It is an excellent tool for finding the best rates and fees. The calculator feature does a fabulous job of breaking down all the available options for sending money from one country to the next.

I am not sure how often the site is updated. Also, be aware that the site uses affiliate links and promoted listings. As such, I’d use the service to narrow down your search and then verify your choices using the tools on each provider’s site to finalize your decision.

Provisos aside, the Monito site (and iOS and Android app) offers a valuable service for anyone researching how to send funds to a collaborator in another country. If your collaborator does not already have a preferred method of receiving funds, this is a great place to start your search for an appropriate financial services company to facilitate paying your talent.

But wait…

So, what service do I use? It depends. Comics are collaborative, so I tend to use whatever service my collaborators want me to use and take the financial hit if necessary.

But left to my own devices, I prefer to send funds in a way that is almost instantaneous and costs pennies regardless of the amount you are sending. Yes, that exists, and I will go over that in part two of this series.

Do you regularly send money to a collaborator in another country? If so, what method or service provider do you use? Please leave your advice in the comments section below.

See 5 Factors That Influence Exchange Rates at Investopedia.com.

I have a feeling I know what solution you're going to bring up in part 2 👀

Great breakdown, Greg. You're always super informative and it's a bonus that you speak to me, as a fellow Canadian, directly!

Not dissimilar to you, I adapt to what folks are asking for. 90% of the time, they prefer being paid via Paypal. How I manage that is I got a business account with Wise, that comes with a prepaid Visa, and charge the Visa via Paypal. This way I avoid the fees from Paypal without having to do any conversions beyond the Wise one.